The fifth biggest US investment bank, Bear Stearns has witnessed a full circle before its fall and selloff to JP Morgan Chase for paltry $2 per share.

The fifth biggest US investment bank, Bear Stearns has witnessed a full circle before its fall and selloff to JP Morgan Chase for paltry $2 per share.

The total deal value is just $236 million (less than even Rs.1000 crore), much much less than the recent BPTP land deal in Noida.

The book value of the company still remains at $84 per share.

The acquisition includes Bear Stearns’ headquarters at Manhattan, which as one of the world’s tallest buildings which alone could fetch more than $1 billion in a sale.

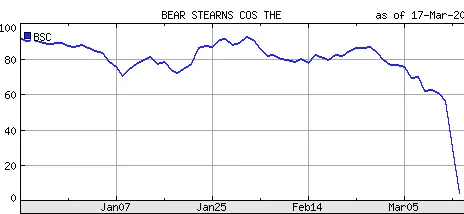

Bear Stearns interesting share price trends

52 Week High - $159.36 (valuing it at $19billion) March 13, 2008 - $57 March 14, 2008 - $30 (valuation of $4 billion) March 16, 2008 - JP Morgan buys Bear Stearns for $2

Comparing Bear Stearns valuations to its Indian counterparts

Merrill Lynch bought Hemendra Kothari’s 50% stake in DSP Merrill Lynch for $500 million, valuing it at $1 billion.

Kotak Mahindra bought out its stake from Goldman Sachs from two Joint Ventures at a valuation of around $300 million.

Bear Stearns effects on Indian markets

Bear Stearns holds stakes in 120 listed Indian companies, with the largest holding in JP Associates and significant stakes in Havells, Jindal Steel & Power, Opto Circuits and Madhucon Projects.

It has sold shares worth Rs.943 crore in last 2 days in Indian markets thus reducing its portfolio value from earlier high of Rs.2000 crores.

With Bear Stearns biting the dust, questions are being raised about who will be the next victim. A good case in point is the 50% drop in share price in 2 days of another investment bank, Lehman Brothers due to similar liquidity concerns. So take your pick.